2025 Medicare Income Brackets For Premiums. Medicare part a costs and deductible. Medicare premiums are calculated using your modified adjusted gross income from your tax return for two years prior to the current year.

However, earnings on your tax forms from two years ago may not reflect your earnings today. The amount you’ll pay for your medicare premiums in 2025 hinges on your modified adjusted gross income (magi).

2025 Irmaa Brackets For Medicare Premiums Dallas Shelia, You’ll pay the premium each month, even. Understanding the 2025 irmaa brackets:

Medicare Premium Tax Brackets 2025 Betty Chelsey, Here are the medicare premiums, deductibles, and copay amounts for 2025. Medicare part a costs and deductible.

The 2025 IRMAA Brackets Social Security Intelligence, The standard part b premium for 2025 is $174.70. In this guide, we break down the costs of.

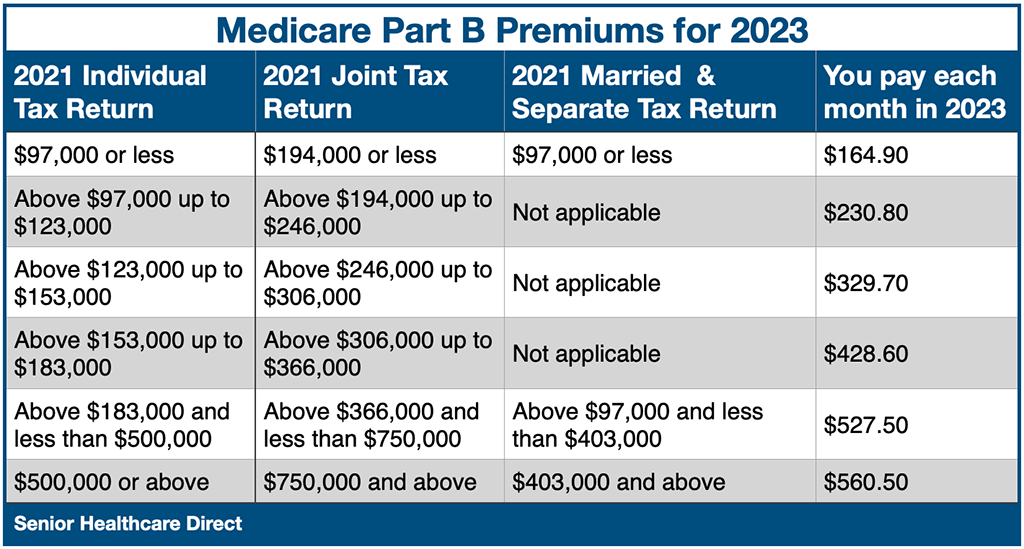

Social Security And Medicare Withholding Rates 2025 Berri Guillema, The income limit for irmaa in 2025 is $103,000 for individuals and $206,000 for couples. Medicare beneficiaries who reported an individual income at or below $103,000 in 2025, or a married couple who earn no more than $206,000 per year in 2025, will now pay $174.70 per month in 2025.

Medicare Part B Premium 2025 Cost Chart, Medicare premiums for 2025 will increase. The annual deductible for all.

The IRMAA Brackets for 2025 Social Security Genius, Irmaa represents the additional amount that some people might have to. In this guide, we break down the costs of.

Medicare Blog Moorestown, Cranford NJ, For example, if you’re paying premiums in 2025, these will be based on your 2025 magi. Here are the medicare premiums, deductibles, and copay amounts for 2025.

2025 For 2025 Irmaa Brackets Kylie Kaylee, What are the irmaa brackets for 2025 and 2025? Medicare beneficiaries who reported an individual income at or below $103,000 in 2025, or a married couple who earn no more than $206,000 per year in 2025, will now pay $174.70 per month in 2025.

Part B Medicare Cost For 2025 Esther Henrieta, The cost of medicare part a deductible, part b and part d are all rising. Here are the medicare premiums, deductibles, and copay amounts for 2025.

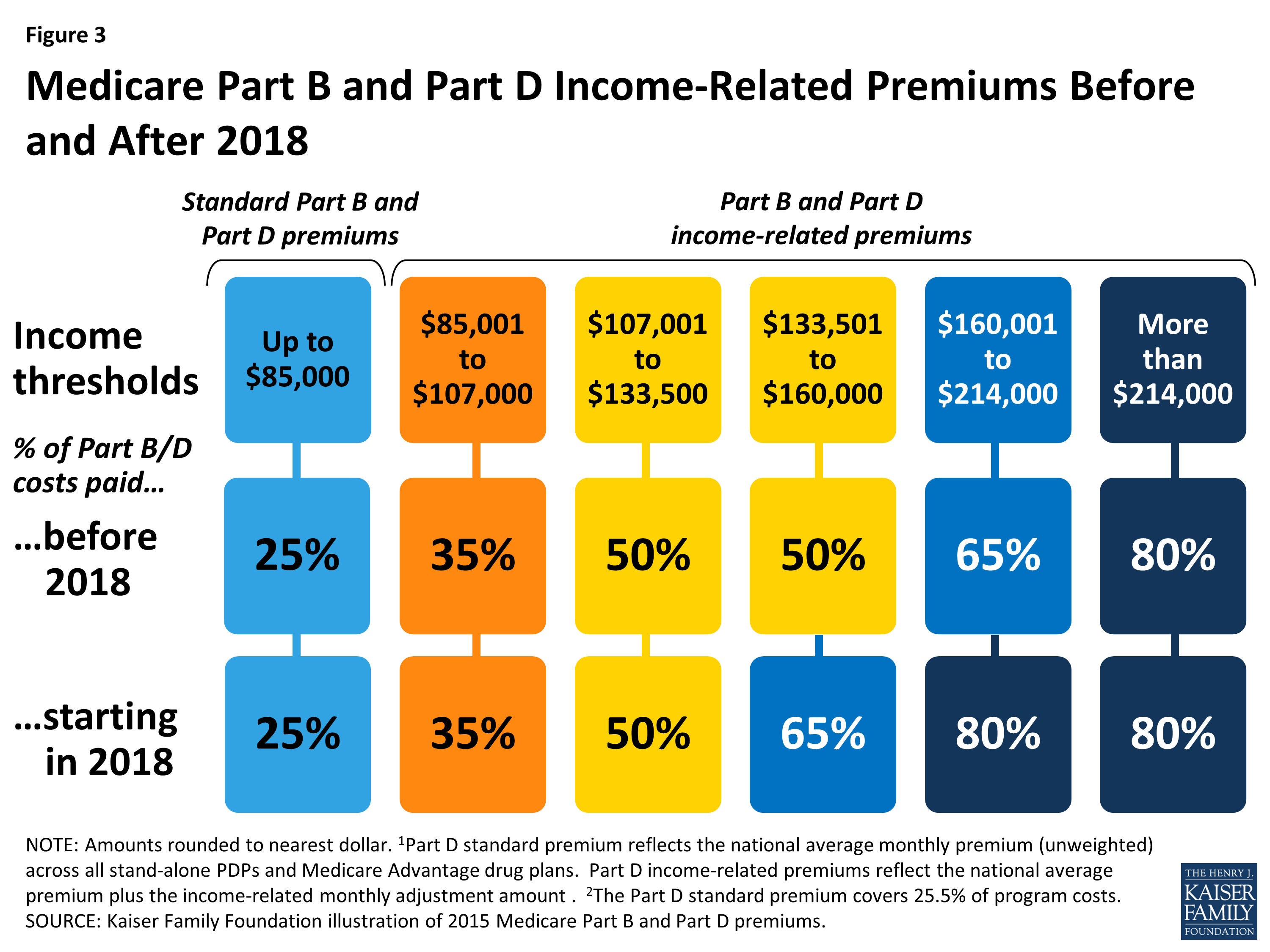

Medicare's Premiums A Data Note KFF, The annual deductible for all. For example, income taxes filed for 2025 will decide how much you will pay for medicare premiums in 2025.

The standard monthly premium for medicare part b enrollees will be $174.70 for 2025, an increase of $9.80 from $164.90 in 2025.